Construction Industry Trends 2025: What Every Project Manager Needs to Know

The construction industry drives 13% of global GDP, making it the single largest industry worldwide. And right now, technology is rewriting the rules—boosting efficiency, safety, and profitability while changing how projects are planned, built, and delivered.

2025 is shaping up to be a transformative year. The BIM market, worth $7.92 billion today, is on track to hit $21 billion by 2034. AI in construction is expected to reach $2.29 billion this year alone, growing at a staggering 30% CAGR. And construction management software is expanding fast, projected to climb from $9.3 billion today to $23.9 billion by 2031.

The impact is real and measurable. Drones are already improving worker safety by 55%. Modular construction, a $91 billion market, is projected to rise to $120.4 billion by 2027. Yet, challenges remain—especially with a tight labour market of just 12 million workers nationwide. On the bright side, demand is strong: healthcare construction spending is set to grow 5.1%, and education-related projects are expected to rise 8.2%.

In this article, we’ll explore how AI, predictive analytics, modular construction, and other tech trends are changing the way projects get managed in 2025—and how you can put them to work in your business.

The 2025 construction economy: what’s shaping the outlook

The economic landscape in 2025 presents a mixed bag of challenges and opportunities for construction professionals. Understanding these economic forces isn't just academic—it directly impacts how we plan, budget, and execute projects in the coming year.

Inflation trends and interest rates

Inflation has finally started cooling after several volatile years, though construction costs remain stubbornly elevated. Material prices have stabilized somewhat but still hover 42% above pre-pandemic levels. This persistent inflation creates a planning headache for project managers trying to estimate costs accurately.

Interest rates present another critical factor shaping construction activity. After the aggressive rate hikes of previous years, the Federal Reserve has finally begun its easing cycle. However, borrowing costs remain relatively high by historical standards, affecting everything from equipment financing to project funding.

For project managers, this environment demands more sophisticated financial planning:

- More frequent cost reviews throughout project lifecycles

- Tighter contingency budgets to account for potential price volatility

- Creative financing structures to mitigate higher borrowing costs

Public vs private sector investment

The balance between public and private sector construction spending reveals interesting shifts in 2025. Public infrastructure spending continues its strong momentum, bolstered by major federal initiatives. The Infrastructure Investment and Jobs Act continues pumping billions into transportation, utilities, and public works projects across North America.

Meanwhile, private sector construction shows a more nuanced picture. Commercial construction has slowed in response to changing workplace patterns, with office vacancies still elevated in many urban centers. However, industrial construction—particularly manufacturing, logistics, and data centers—remains robust as companies rebuild supply chain resilience.

Residential construction presents yet another storyline. Housing starts have recovered somewhat from their interest rate-induced slump, though affordability challenges persist. The multi-family sector shows particular strength as housing shortages continue plaguing major metropolitan areas.

Regional growth disparities

Perhaps most striking in 2025's construction landscape is the pronounced regional variation. The Atlantic provinces have experienced a remarkable 170% jump in construction starts, creating intense competition for labor and materials in previously slower markets.

In stark contrast, Alberta continues struggling with construction starts down nearly 50% compared to last year. These regional disparities create significant workforce mobility challenges as skilled labor follows opportunity.

The U.S. shows similar regional variations. The Southeast and Southwest maintain their construction booms while some Midwestern and Northeastern markets experience more modest growth. These regional differences make standardized approaches to project management increasingly difficult.

Smart project managers recognize these regional variations demand localized strategies:

- Adjusting labor rates based on regional competition

- Sourcing materials locally when possible to reduce logistics costs

- Building relationships with regional subcontractors who understand local conditions

As we navigate 2025's construction economy, adaptability becomes our most valuable skill. The project managers who thrive will be those who continuously monitor these economic indicators and adjust their strategies accordingly.

Labour shortages and workforce shifts

The construction industry faces a critical challenge that's growing more urgent each day: finding enough skilled workers. This labor gap isn't just a temporary setback—it's reshaping how projects get built.

Why skilled labour is still hard to find

The industry needs an estimated 439,000 additional workers in 2025 alone to meet anticipated demand. This shortfall isn't surprising when you look at the demographics. Roughly 20% of the construction workforce will retire in the next decade, creating a vacuum of experience that's difficult to fill.

In fact, census data reveals there were fewer working-age people with apprenticeships in key construction trades in 2021 compared to five years earlier. This decline coincides with decades of emphasis on four-year college degrees over vocational training, leaving many young people unaware that construction careers often offer competitive wages without the burden of student debt.

First-year wage increases in construction averaged 4.6% by mid-2024, with 91% of firms reporting they increased base pay rates for hourly positions. Despite these incentives, 94% of construction firms still struggle to fill positions.

The role of immigration and policy changes

Immigration policy has become increasingly important to the construction labor equation. Currently, immigrants make up one in four workers in the industry overall. For construction tradespeople specifically, that number jumps to 32.5%.

The concentration is particularly high in trades essential for home building:

- 61% of plasterers and stucco masons

- 61% of drywall/ceiling tile installers

- 52% of roofers

- 51% of painters

Recent policy changes and enforcement actions have created uncertainty. As of 2024, 65% of builders reported shortages of workers performing finished carpentry. Moreover, many industry experts worry that enhanced enforcement without visa reform could worsen existing shortages.

Upskilling and reskilling strategies

To address these challenges, forward-thinking companies are investing in their existing workforce. About 42% of firms have increased spending on training and professional development programs.

The Canadian government, for example, is investing in 1,500 internationally trained professionals to help them join the skilled trades workforce. Similarly, the U.S. has implemented programs like the Canadian Apprenticeship Service, offering financial incentives to small and medium-sized employers who hire and train new first-year apprentices.

For project managers, this means budgeting for ongoing training rather than treating it as optional. Learning management systems are becoming essential tools for construction companies looking to develop talent internally rather than competing for scarce external resources.

Material costs and supply chain pressures

Material costs continue to be a major headache for construction projects in 2025, with prices still hovering 42% above pre-pandemic levels. Even as some stability returns to certain markets, new volatility factors create ongoing challenges for project budgeting and procurement.

What's driving price volatility in 2025

Global labor shortages remain a primary factor pushing construction expenses upward. Although labor availability has shown modest improvement, with markets reporting skill shortages decreasing from 79.1% to 71.7%, these constraints continue driving up costs across the supply chain.

Electrical materials face particularly severe pressure due to surging demand in specific sectors. Components like generators, switch gear, and condenser units now have significantly longer lead times compared to other construction materials. The explosive growth in data center construction is largely responsible, creating unprecedented demand for copper-intensive systems.

HVAC components tell a similar story. Orders are at historic highs, yet domestic production lags behind, with almost 36% of demand now filled by imports. Consequently, project managers find themselves competing for limited resources as suppliers struggle to catch up.

First-time developers often underestimate these sector-specific pressures. What worked in your budget last year might be wildly insufficient today, especially for projects requiring substantial electrical infrastructure.

Tariffs, trade policy, and global sourcing

Trade policy changes in 2025 have dramatically reshaped the construction materials landscape. Recent actions have expanded tariffs across a much broader range of building materials than in previous years.

The numbers tell a sobering story:

- The effective tariff rate on US construction imports has surged to 27.7%, up from just 0.9% prior to recent policy changes

- Roughly one-third of construction-related goods are imported

- Steel and aluminum tariffs increased to 50% in recent months

- A similar 50% duty on copper takes effect August 1, 2025

These policies impact far more than just imported materials. Domestic producers have responded with their own price increases, as seen when steel mill products increased by 5.1% over the past year despite lower production capacity. Aluminum mill shapes climbed 6.3% in the same period.

For projects dependent on wood-frame construction, lumber tariffs create additional pressure. The Commerce Department currently imposes 14.5% tariffs on Canadian lumber (which accounts for 85% of US imports) and has signaled plans to more than double this rate to 34.5%.

How project managers can plan around uncertainty

Given these volatile conditions, successful project managers are adapting their approach to material procurement and contracting:

- Include price escalation provisions in contracts to protect against unexpected increases. Tools like material price escalation amendments can document the impact of tariffs for change orders and potential claims.

- Establish clear delivery and supply terms that define sourcing and timelines to manage expectations and minimize disruptions when markets shift.

- Consider strategic material stockpiling for critical components, though this requires storage logistics planning and upfront capital.

- Diversify supplier relationships across different regions to reduce dependency on single sources vulnerable to trade policy changes.

The construction industry has largely adjusted to this new reality, yet remains "delicate in some areas". By adopting these strategies, project managers can navigate material cost volatility while keeping projects on track and budgets under control.

Technology trends every project manager should track

.jpg)

Building Information Modeling (BIM) adoption rates

BIM has hit a turning point. Recent data shows 74% of architecture firms now use BIM. Large architecture firms have gone all-in, with 100% using it for billable work. The technology has become a standard across the industry. About 73% of practices know about and use BIM, up from 62% in 2017.

Projects are getting more integrated. Almost half of the companies surveyed use BIM on 76-100% of their projects. About 23% use it on everything they do. Countries worldwide are taking notice. The UK now requires BIM standards (ISO 19650) for government contracts and public sector projects worth over £5 million.

Construction professionals love BIM for three main reasons:

- They catch and fix quality issues faster (65%)

- Teams work better together (63%)

- Everyone understands design decisions better (63%)

Money talks, and BIM delivers. Companies using BIM see a 25% reduction in labor needs. They also get 25% better efficiency, spend 5% less overall, and build 5% faster. BIM helps manage risks too. Projects are 30% less likely to face delays, and risk-related costs drop by up to 25%.

BIM has grown way beyond its original purpose. What began as 3D modeling now includes 8D models that handle scheduling, costs, and facility management. BIM is becoming Digital Information Management (DIM). This new approach manages entire construction projects by combining immediate data, IoT connectivity, and cloud-based tools.

Construction Management Software: Key features and benefits

Today's construction management software helps projects run smoothly. These platforms bring information together, make work easier, and keep everyone connected throughout the project.

Research reveals construction professionals waste about 35% of their time (over 14 hours each week) looking for information and fixing conflicts. Poor project management and miscommunication cause 48% of all rework. That's why good software solutions are crucial.

Money matters tell the story. Direct rework costs eat up 4-6% of total project budgets. Add indirect costs, and that number jumps to 9%. Budget-friendly construction management software that cuts down errors and improves teamwork pays for itself.

Today's construction management platforms offer:

- Real-time collaboration tools that link office and field teams

- Cloud-based document management that puts information at everyone's fingertips

- AI-driven analytics to plan resources and spot risks

- IoT integration that watches sites and tracks equipment

- Automated approval workflows to speed up decisions

The best solutions work from start to finish, covering design, construction, and operations. These complete platforms let teams see better, plan smarter, work safer, and team up more effectively.

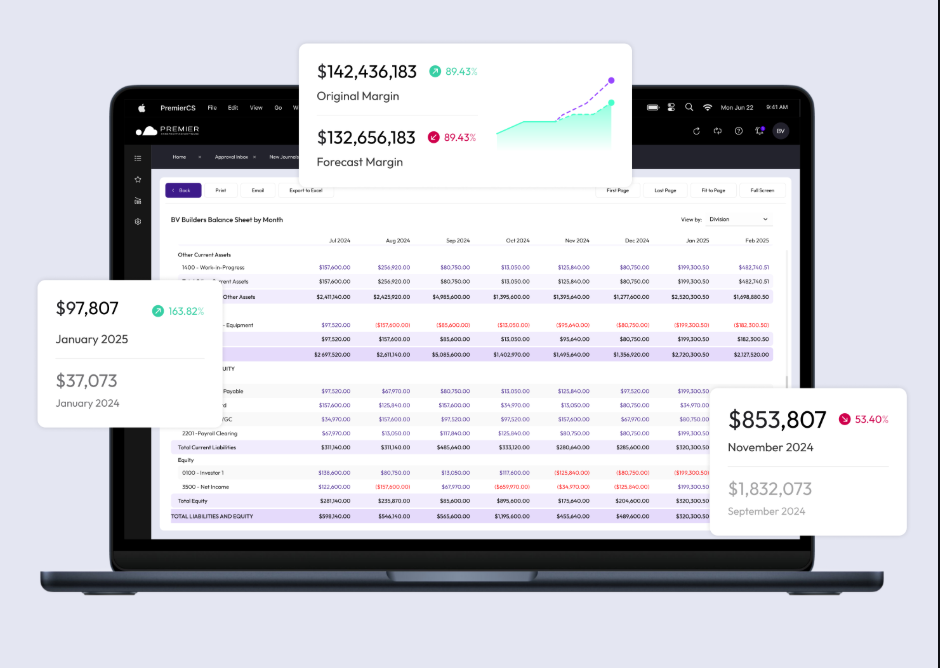

PremierCS: A leader in construction software solutions

Premier Construction Software stands out in construction management. This modern, cloud-based construction ERP software built specifically for construction gives teams one system to handle everything - from money and accounting to job costs, project management, and field work.

General contractors, owners, and developers of all sizes use the platform. Teams don't have to juggle multiple systems anymore. Data flows smoothly between different parts of the business.

Premier's construction accounting system tackles common industry headaches like scattered data, slow manual work, and gaps between office and field teams. Teams work faster and make more money because the platform automates processes and provides analytical insights.

Premier shines with its ability to run multiple entities and projects from one dashboard. Teams can see combined financial reports and handle transactions between companies. The platform is incredibly easy to use - it cuts down clicks by about 80%.

Architects, clients, and subcontractors get their own portals to work together smoothly. Quick approvals for invoices, RFIs, changes, and purchase orders mean faster turnaround times and better accountability.

AI and predictive analytics in project planning

AI and predictive analytics are changing how we plan construction projects. These technologies give us amazing accuracy in predicting outcomes and making the best use of resources. Construction professionals now rely on data-based decisions to tackle complex challenges.

AI for resource allocation and scheduling

AI makes resource management better by looking at live data to distribute labor, equipment, and materials across projects efficiently. This smart approach cuts waste and project costs. Smart scheduling systems create realistic timelines by looking at resource availability, weather conditions, and possible risks that usually cause delays.

AI helps optimize resources in several ways:

- Improved efficiency: AI systems can look through huge amounts of data from old projects to spot potential problems, so managers can act early

- Better productivity: Companies that use AI to manage their workforce have seen 12% increases in labor productivity

- Lower costs: Projects that use AI to assign resources have cut spending by 10% through better resource use

- Better supply chains: AI tools help predict what materials you'll need and keep inventory just right, so materials show up right when you need them

Construction managers can now focus on bigger picture planning instead of routine tasks. AI takes care of repetitive work, which gives employees more time to think strategically. Projects that use AI planning tools have cut delays by up to 20%, showing real results from this technology.

Predictive analytics for risk mitigation

Predictive analytics is the life-blood of modern construction risk management. Smart models look at past project data and outside factors like market trends and weather forecasts to figure out how likely risks are to happen. Project teams can stop problems before they start.

This technology really shines when it comes to spotting safety hazards. It studies safety incidents and related factors to find patterns, which helps teams prevent accidents and make job sites safer. Companies using AI safety tools have seen workplace accidents drop by up to 25%.

Teams can also spot wasteful practices like material waste and poor resource use. Past data helps make good estimates of job costs and timelines. This analytical approach cuts risk and helps projects finish on time.

Predictive analytics turns risk management from reactive to proactive. Systems spot patterns that come before common problems like delays, cost overruns, or safety incidents. Project managers can fix issues before they become real problems.

Modular and prefabricated construction gains momentum

Modular and prefabricated construction continues to transform the building sector faster in 2025. This new approach manufactures building components off-site before transporting them to assembly locations. The method provides solutions to common industry problems like labor shortages, tight deadlines, and sustainability requirements.

Benefits of off-site construction

Traditional methods fall short compared to off-site construction advantages. The controlled factory environment boosts quality control by removing variables like weather conditions and labor inconsistencies. Buildings perform better long-term because precision manufacturing ensures proper lineup and fewer installation problems.

The environmental benefits are remarkable. Factories use resources more efficiently. Modular construction creates 50% less waste than traditional projects. Materials get optimized in manufacturing environments, which helps earn green building certifications. Modular buildings use 67% less energy during construction than standard buildings.

Worker safety improves dramatically with this approach. Moving high-risk tasks from construction sites to controlled factory spaces reduces worker exposure to dangers. The reduction in dangerous on-site work creates a safer environment with fewer accidents and injuries.

Modular construction also delivers:

- Enhanced precision through standardized manufacturing processes

- Reduced noise and disruption in surrounding communities

- Better waste management through recycling and material reuse

- Decreased vehicle traffic at construction sites (56% fewer vehicle movements)

Industries leading modular adoption

Market research shows 27% of all planned new buildings in 2025 will use prefabrication. This number should reach 35% by 2030. Adoption rates vary by industry type.

Education leads the pack in modular building use. Schools and universities choose prefabricated solutions to handle enrollment changes quickly with minimal disruption. Healthcare facilities come next, as hospitals and emergency care units need high-quality structures built faster.

Hotels have invested heavily in modular construction. Marriott International built several modular hotels to prove this method works well. Government buildings often use prefabricated solutions because of budget constraints and strict building codes.

Commercial spaces, retail outlets, and apartment complexes round out the main users. The industry serves multiple markets: multifamily housing (20%), office buildings including government facilities (18%), educational buildings (15%), retail (11%), and healthcare (6%).

Impact on project timelines and budgets

Project managers find the financial and scheduling benefits compelling. Prefabricated methods build projects 30-50% faster than traditional construction. This speed comes from parallel processing - site preparation happens while factories build modules.

The cost benefits stand out too. Off-site construction saves 20% of total construction costs for low-rise multifamily projects compared to traditional methods. Lower labor costs, less material waste, and quicker completion drive these savings. One healthcare project finished two months early and returned $5.6 million directly to the owner.

The United States lags behind other countries. Modular construction makes up just 3% of U.S. residential construction. Finland, Norway, and Sweden use it for 45% of projects, while Japan stands at 15%. This gap shows room for growth as builders discover prefabrication benefits.

Rising material and labor costs make modular construction an attractive option for efficient, high-quality buildings. McKinsey & Company expects cost savings up to 20% through better productivity with modular methods.

Smart cities and IoT integration in construction

IoT integration in urban development creates new opportunities for the construction sector in 2025. Smart city initiatives represent a global market of $410.8 billion. This market should reach $820.7 billion over the next few years. These numbers show a significant shift in how construction companies approach infrastructure and building projects.

What defines a smart city?

Smart cities use information and communication technologies to streamline processes, share information with the public, and improve government services and citizen welfare. These urban centers utilize technology and data to create efficiencies, improve sustainability, boost economic development, and enhance residents' quality of life.

Smart cities embody an urban model that blends technology, human capital, and governance to boost sustainability, efficiency, and social inclusion. They do more than deploy digital technologies. The cities create interactive and responsive administrations, safer public spaces, and meet changing population needs.

Smart cities need three major components:

- Networks of sensors and connected devices that collect data

- Connectivity between networks, data, and government systems

- Open data sharing to communicate results and improvements

These intelligent urban environments build on the merger of people, technology, and processes. The components interact through healthcare, transportation, education, and infrastructure. This blend enables real-time responses to urban challenges through informed decision making.

IoT-enabled infrastructure and buildings

IoT applications in construction have grown faster during the Construction 4.0 era. IoT enables data collection on safety parameters like temperature and air quality. It also tracks movement of people, equipment, and materials on construction sites.

Smart buildings gather actionable data from user devices, sensors, systems, and services on the premises. These buildings apply collected data through artificial intelligence and machine learning. The result makes them programmable and responsive to users' and building managers' needs.

Key IoT applications in construction include:

Sensors monitor various conditions like temperature, humidity, air quality, noise, and dust. These sensors communicate data in real-time and trigger alerts when environmental metrics reach unsafe levels. IoT-enabled tags track location and usage of materials and equipment. Contractors locate materials in laydown yards and monitor high-value equipment. Teams attach sensors to rebar before pouring concrete. This enables them to monitor curing and confirm strength gain without core tests.

BIM's connection with IoT marks a major advancement. Construction projects with BIM support become more common, making this interconnection increasingly important. Site activities link directly to 3D models. This highlights exact problem locations when sensors detect issues.

Examples of smart city construction projects

Cities worldwide have successfully implemented IoT solutions to improve urban sustainability and livability. Tokyo's partnership with Fujisawa Sustainable Smart Town (SST) shows power utilities' future transformation needs. This smart and sustainable town emphasizes transportation, energy, and town spaces. It demonstrates practical applications of smart city concepts.

Singapore's government works with AVEVA to transform Punggol, an area in northern Singapore, into a visualization-ready digital twin. This project combines IoT and AI to create a living laboratory. It tests and refines various products and concepts to promote better decisions and situational awareness.

Copenhagen stands out as a smart city that uses technology effectively for environmental friendliness and quality of life improvements. The city's informed approach enables quick improvements. These reduce traffic congestion, air pollution, and CO2 emissions. Copenhagen aims to become the world's first carbon-neutral city by 2025.

Barcelona has implemented IoT in its smart grid system. The system monitors energy consumption, manages renewable energy sources, and optimizes electricity distribution. The city developed "Sentilo," which measures data points on 150,000 lamp posts, 40,000 garbage containers, and 80,000 parking spots. This provides open access data about energy use, noise levels, and other urban metrics.

Construction professionals who know how to integrate IoT technologies into their projects will gain competitive advantages in this growing market segment.

Sustainable construction and green building practices

Green building practices are the life-blood of 2025 construction industry trends. Companies now prioritize environmental responsibility among other project goals like profitability. Market demands for eco-friendly structures, evolving regulations and growing climate concerns drive this sustainability push.

Energy-efficient design and materials

Energy-efficient design aims to reduce a building's energy consumption through strategic construction approaches. The building envelope (foundation, roof, walls, doors, windows) is the main factor that affects total energy consumption because it determines interior climate conditions. Modern buildings are bringing back passive temperature control techniques that builders abandoned after electrical energy became accessible to more people.

Optimizing heating and cooling design remains the quickest way to reduce energy costs. Building designs that follow energy-saving criteria need more original investment but reduce costs by a lot throughout the building's life cycle with lower energy use. End users save money and society benefits from reduced CO2 emissions with this approach.

Windows need special attention since 10-20% of heat loss in standard homes happens through them. The building's façade elements need proper shading to control solar radiation, which works especially well on façade cavities.

LEED certifications and ESG compliance

LEED (Leadership in Energy and Environmental Design) is the most recognized green building rating system worldwide. This framework covers energy and water use, materials selection, waste management, and indoor environmental quality.

Projects earn LEED certification points in a variety of categories, with four certification levels:

- Certified: 40-49 points

- Silver: 50-59 points

- Gold: 60-79 points

- Platinum: 80+ points

Environmental, Social, and Governance (ESG) practices have grown beyond basic compliance requirements into powerful competitive advantages in construction. The environmental pillar targets lower emissions, less waste, and eco-friendly materials. Reducing greenhouse gas emissions, using low-impact building materials, managing construction waste, and designing for climate resilience are the key environmental targets.

Carbon-negative and recycled materials

Carbon-negative materials capture more carbon than they release during production. Northwestern University's scientists created a new carbon-negative building material using seawater, electricity, and CO2. Their process locks away carbon dioxide permanently while creating valuable materials for concrete, cement, plaster, and paint manufacturing.

U.S. industries produce over half a billion tons of potentially usable materials each year, including construction and demolition materials. Builders achieve conservation goals through recycled building materials that decrease energy use and greenhouse gas emissions. Natural resource conservation and pollution reduction happen when recycled industrial materials replace virgin materials that need mining and processing.

Recycled materials often cost less than virgin materials, which makes economic sense for builders and project owners. Some recycled materials like fly ash and slag cement even perform better than virgin materials.

Advanced materials: From biocement to self-healing concrete

State-of-the-art materials are transforming building techniques as we approach 2025. These advanced solutions perform better than traditional materials and tackle environmental issues in ways conventional materials can't match.

Living building materials explained

Living building materials (LBMs) work just like living organisms. They can fix themselves and even make copies of themselves. Scientists developed these materials by studying how coral creates minerals. The results include biocement, self-replicating concrete, and mycelium-based composites.

Biocement develops through microbiologically induced calcite precipitation (MICP). Tiny organisms create spots where CaCO₃ can form. The amazing thing about biocement is how it heals itself. When cracks appear and water gets in, sleeping bacteria wake up. They eat calcium lactate and produce limestone that fills the damage.

Self-replicating concrete takes this idea even further. This material uses a sand-hydrogel mixture where synechococcus bacteria grow and make calcium carbonate. Regular concrete releases huge amounts of CO₂. These bacteria do the opposite - they actually absorb carbon dioxide.

Smart materials and embedded sensors

Smart materials adapt to their environment using built-in sensor systems. Scientists have woven fiber-optic sensors into composites to monitor material conditions live. These tiny sensors fit perfectly between CFRP sheets and inside 3D-printed parts.

Shape memory alloys (SMAs) mark another breakthrough in the field. These materials change their properties when added to laminated composites. They create internal forces and adjust stress levels in controlled ways.

High-definition fiber optic sensing technology measures continuously along the sensor's entire length. It provides sub-millimeter accuracy and better coverage than old-style point sensors.

Mass timber and carbon-capturing concrete

Mass timber has become a great alternative to concrete and steel. This includes cross-laminated, nail-laminated, and glue-laminated timber. It costs about the same as traditional materials but leaves a smaller carbon footprint.

The environmental impact is impressive. Trees store carbon as they grow. That carbon stays locked away when the wood becomes mass timber products. Using these materials instead of concrete and steel cuts emissions by 13% to 26.5%.

Carbon-capturing concrete technologies like CarbonCure add another layer of innovation. They pump CO₂ into fresh concrete where it turns to mineral and stays trapped forever. This process makes the concrete stronger while storing carbon.

Robotics and automation reshape the jobsite

Construction sites now have robots and autonomous machines that handle dangerous and repetitive tasks. This shift marks a physical aspect of the digital world's impact on construction. These machines help solve worker shortages and make sites safer and more productive.

Construction robots: TyBOT, SAM, and more

TyBOT excels at the back-breaking work of tying rebar with 99% accuracy. The robot works among crews and ties more than 1,200 rebar intersections every hour without needing pre-mapping or programming. A great example comes from the Freedom Road bridge in Pennsylvania, where TyBOT tied 24,000 intersections at 5.5 seconds each.

SAM (Semi-Automated Mason) makes bricklaying safer and less physically demanding. This robot places 380 bricks per hour, six times faster than human masons. Construction Robotics developed SAM, which has boosted on-site efficiency for almost a decade.

Specialized robots like Robo-Carrier move heavy materials, while Robo-Welder handles steel column welding by using laser shape measurement to find object contours. These robots cut down manpower needs for specific tasks by 70-80%.

Autonomous vehicles and drones

Construction drone market value should reach almost $12 billion by 2027. These flying robots map and measure sites quickly, which reduces manual survey requirements. New surveyors using drones can cover 120 acres hourly, making the work 60 times more efficient.

Drones watch construction progress in real time and spot potential issues early. Their detailed images allow thorough quality inspections. This technology helps reduce rework, resolve conflicts faster, and eliminates searches for missing project data, problems that cost construction companies $177 billion yearly.

Self-driving construction equipment operates legally in 22 U.S. states. Companies like Komatsu, Caterpillar, and John Deere make autonomous vehicles that work with incredible precision and use fuel efficiently.

Field layout automation with Dusty Robotics

Dusty Robotics' FieldPrinter 2 puts digital blueprints right onto construction sites. This compact 23-pound robot comes with a wider print head and better navigation sensors.

The FieldPrinter works 10 times faster than manual methods and prints 10,000-15,000 square feet daily with one operator. The robot achieves 1/16" accuracy at 600 DPI and prints as close as 1¾" from obstacles.

This technology helps bridge gaps between project teams. Andrea Hernando, Senior Construction Tech Innovation Engineer, explains: "With Dusty we're able to have everybody work together and we can see if there are issues with layout points in the CAD before we lay them out in the field".

Key Takeaways

The construction industry in 2025 demands strategic adaptation to overcome persistent challenges while capitalizing on emerging opportunities. Here are the essential insights every project manager needs to succeed:

• Labour crisis requires immediate action: With 439,000 additional workers needed in 2025 and 20% of the workforce retiring within a decade, invest in upskilling programs and embrace prefab/modular construction to reduce on-site labor demands.

• Material costs demand proactive planning: Construction costs remain 42% above pre-pandemic levels, with new tariffs reaching 27.7% on imports. Include price escalation clauses in contracts and diversify supplier relationships to manage volatility.

• Technology adoption is no longer optional: AI-powered predictive analytics improve project quality by 20%, while BIM and digital twins enhance collaboration. These tools are becoming essential for competitive advantage, not luxury additions.

• Sustainability drives profitability: Green buildings are 25% more energy-efficient and reduce operational costs by up to 37%. ESG compliance isn't just about compliance—it's smart business that delivers measurable returns.

• Regional strategies beat one-size-fits-all approaches: With construction starts varying dramatically by region (Atlantic provinces up 170%, Alberta down 50%), successful project managers adapt their workforce, pricing, and procurement strategies to local market conditions.

The construction leaders who thrive in 2025 will be those who view these challenges as catalysts for innovation rather than obstacles to overcome.

FAQ

Q1. What are the key challenges facing the construction industry in 2025? The main challenges include persistent labour shortages, material cost volatility, and regional market disparities. Additionally, the industry is grappling with the need for rapid technology adoption and increasing sustainability requirements.

Q2. How is technology transforming project management in construction? Technology is revolutionizing project management through AI-powered predictive analytics, BIM and digital twins for enhanced collaboration, and increased use of drones and robotics on job sites. These innovations are improving project planning, risk management, and overall efficiency.

Q3. What strategies can project managers use to address labour shortages? Project managers can invest in upskilling and reskilling programs, embrace prefabrication and modular construction methods, and leverage technology to reduce on-site labour demands. Additionally, they may need to adjust their recruitment strategies and consider the role of immigration in filling skill gaps.

Q4. How can construction projects meet sustainability goals without exceeding budgets? Sustainable construction can be cost-effective through strategies like using low-carbon materials, implementing smart building technologies, and conducting life cycle cost analyzes. Green buildings often lead to long-term operational cost savings, making sustainability a smart financial decision.

Q5. What economic factors are shaping the construction outlook for 2025? Key economic factors include inflation trends, interest rates, the balance between public and private sector investment, and significant regional growth disparities. Project managers need to closely monitor these factors and adapt their strategies accordingly to navigate the evolving economic landscape.